infrastructure to power the world’s money

Trusted by leading organisations globally

We move £145BN of global FX volumes – and growing...

Your customers expect to move money globally in the same fast, easy way they do domestically. Our capabilities help unlock that customer experience. View the Payments Success report to explore how

* Payment speed % rates at Q4 FY25

<20 Second Payments

74% of instant payments take under 20 seconds; 96% under 24 hours.

160+ countries 40+ currencies

Connect easily and open up the specific currency routes you need.

70+ licences worldwide

Local compliance expertise combined with automated detection.

>99% STP rate on transfers

Seamless payments to help reduce your customer-support burden.

Real time,

dependable

correspondent

services

Fast, robust, secure global infrastructure

Powered by 950+ engineers, helping to make global payments as convenient as domestic.

Direct participation in 8 domestic payment networks

Send quickly, reliably, at low cost – in Australia, Brazil, Europe, Hungary, Japan, the Philippines, Singapore and the UK.

Connect easily with Swift or API

Send Swift messages, just like with any other correspondent. Or use the Wise Platform API.

Real time,

dependable

correspondent

services

Fast, robust, secure global infrastructure

Powered by 950+ engineers, helping to make global payments as convenient as domestic.

Direct participation in 8 domestic payment networks

Send quickly, reliably, at low cost – in Australia, Brazil, Europe, Hungary, Japan, the Philippines, Singapore and the UK.

Connect easily with Swift or API

Send Swift messages, just like with any other correspondent. Or use the Wise Platform API.

Connect seamlessly to low-cost payouts

Efficient, reliable payouts worldwide

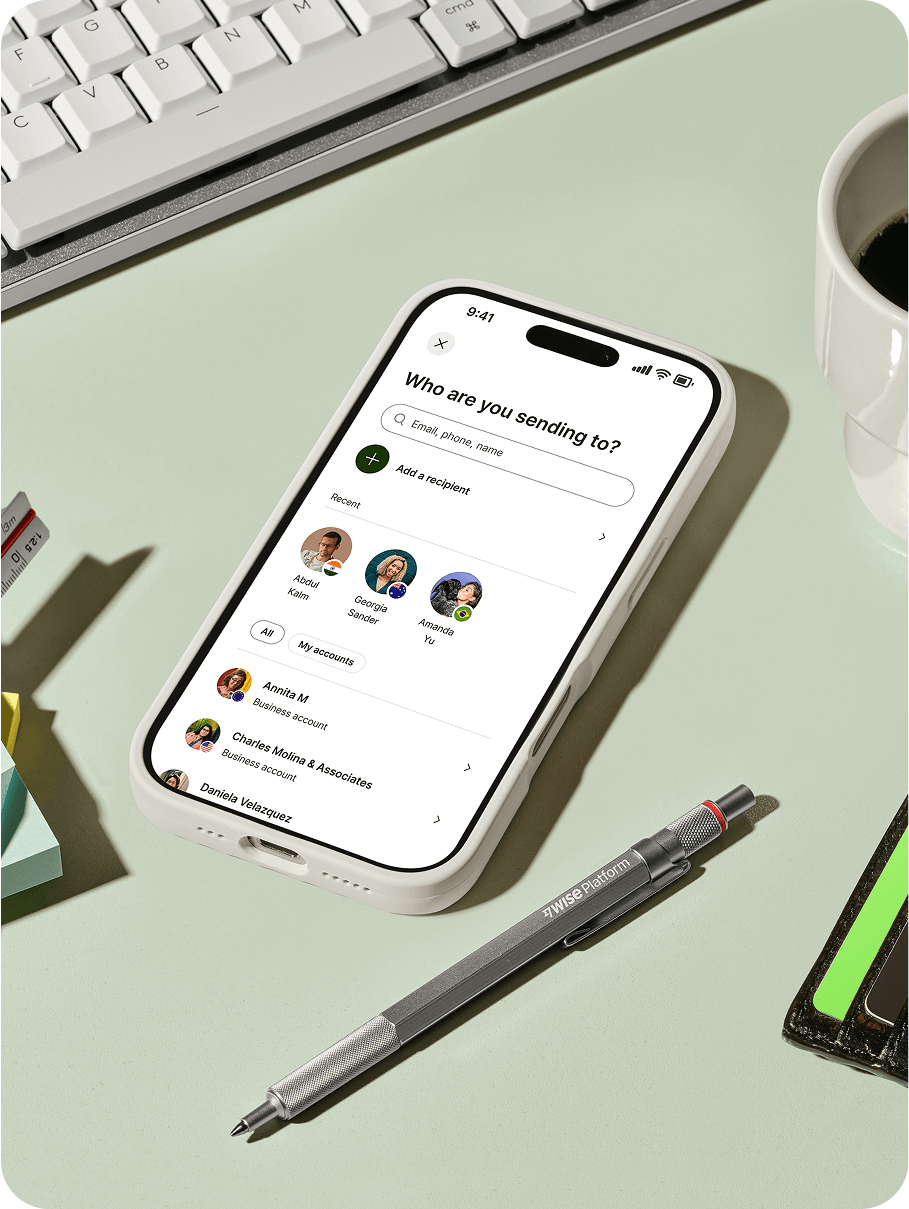

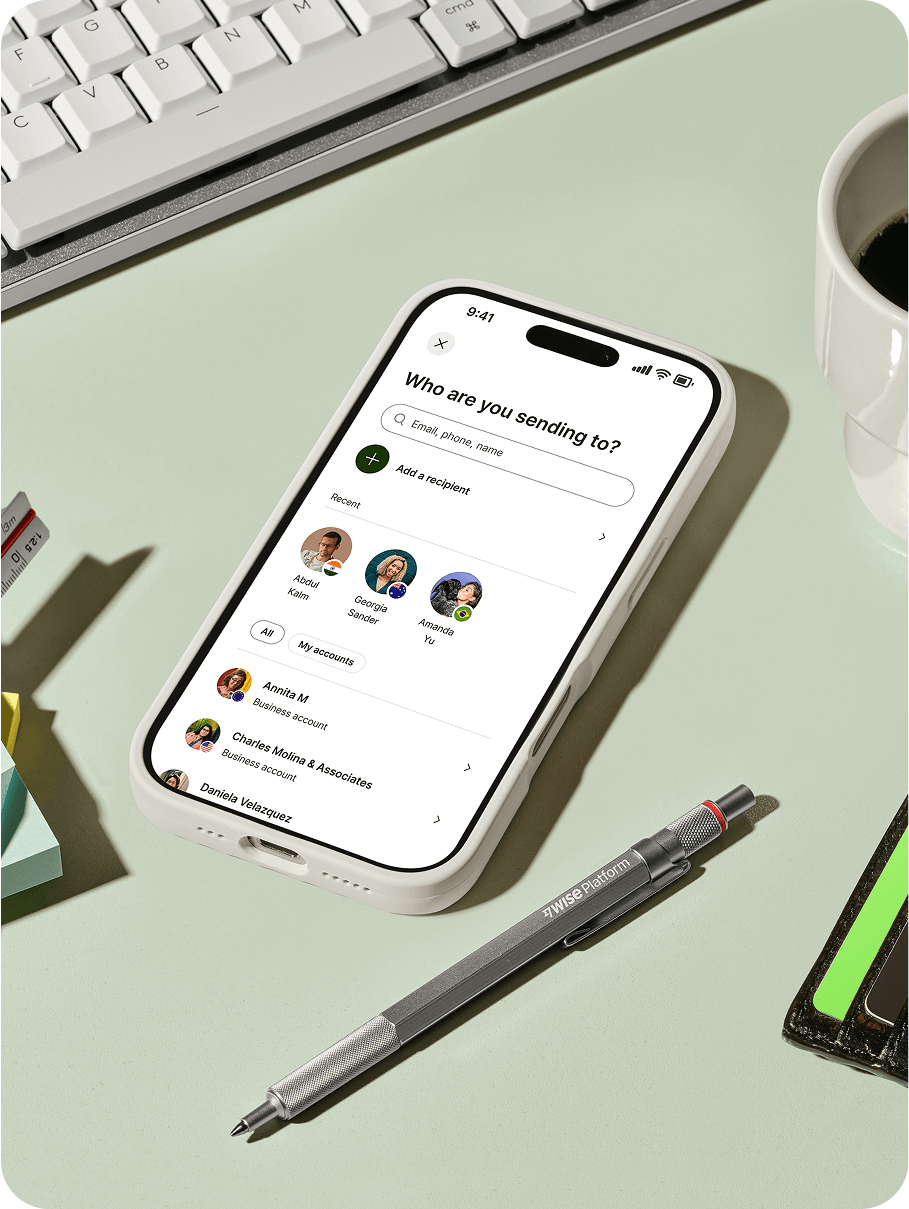

Local, global or mass market payouts, empower end-users to get paid precisely – the way they want, exactly when they need.

Plug in customisable onboarding and KYC

Easily integrate the comprehensive onboarding and KYC capabilities and servicing already used by millions of Wise customers. Make it available as part of your own product experience.

Find flexible solutions for your industry

Offer greater visibility over payments, helping build trust and reduce inbound queries. Spend management , travel , education , marketplaces , workforce and other platforms can move money seamlessly via API.

Connect seamlessly to low-cost payouts

Efficient, reliable payouts worldwide

Local, global or mass market payouts, empower end-users to get paid precisely – the way they want, exactly when they need.

Plug in customisable onboarding and KYC

Easily integrate the comprehensive onboarding and KYC capabilities and servicing already used by millions of Wise customers. Make it available as part of your own product experience.

Find flexible solutions for your industry

Offer greater visibility over payments, helping build trust and reduce inbound queries. Spend management , travel , education , marketplaces , workforce and other platforms can move money seamlessly via API.

Plug-in the products designed to lower costs and boost loyalty

Deliver fast, dependable global payouts

Access one of the world’s largest local payment networks with a dedicated focus on making cross-border payouts faster, more transparent, convenient and low cost.

- Direct participation in 8 domestic payment networks

- 74% of payments in under 20s; 96% under 24hrs

- Covers 160+ countries and 40+ currencies

Partnering with us

We’ll collaborate with you across the delivery journey

- Structured approach to deliveryStructured approach to delivery

You’ll benefit from proven work-streams developed to guide your team from project initiation to launch. We’ll partner with you to define timelines and ensure a low-friction, efficient integration.

- Dedicated team to guide and support youDedicated team to guide and support you

Deep expertise and guidance is available to you throughout your integration. We share best-practice and learnings on building the right product for you and your customers.

- Deep dive workshops and trainingDeep dive workshops and training

Available to you and your team, covering topics such as: Product & Tech; Compliance; Settlement & Ops; Customer Support and; Go-to-Market activities.

How we’re regulated around the world

With 70+ licences globally, our robust mix of innovative technology and local regulatory expertise works to keep your money secure and available. We’re committed to ensuring funds move safely and compliantly.

DELIVER PERFORMANCE AT SCALE WITH OUR API

Seamlessly integrate your systems with our robust API

and revolutionise your cross-border payments

Register for

Wise Connect ’25

Our flagship cross-border payments conference takes place in London, San Francisco and Singapore. Register for your place.

Stay up to date with everything Wise Platform

Want the latest news from Wise Platform? Visit our blog.

Why Swift and Wise Platform teamed up

MD Steve Naudé explains the thinking behind Wise Platform's collaboration with Swift and how it helps banks.

Key takeaways from Sibos Frankfurt

We were delighted to explore the future of cross-border payments with so many people at Sibos. View our key takeaways – and if you missed our team in Frankfurt, no problem, you can connect with them here.

From the boardroom:

Annual Report

Our infrastructure sets us apart. Learn how it helped power the performance of all Wise products and partnerships in the past financial year.

View our

case studies

Find out how we partnered

with Bank Mandiri to power fast,

affordable payments for customers

in Indonesia. Learn more.