REAL-TIME, DEPENDABLE CORRESPONDENT SERVICES

* Payment speed % rates at Q4 FY25

REAL-TIME, DEPENDABLE CORRESPONDENT SERVICES

* Payment speed % rates at Q4 FY25

Trusted by leading organisations globally

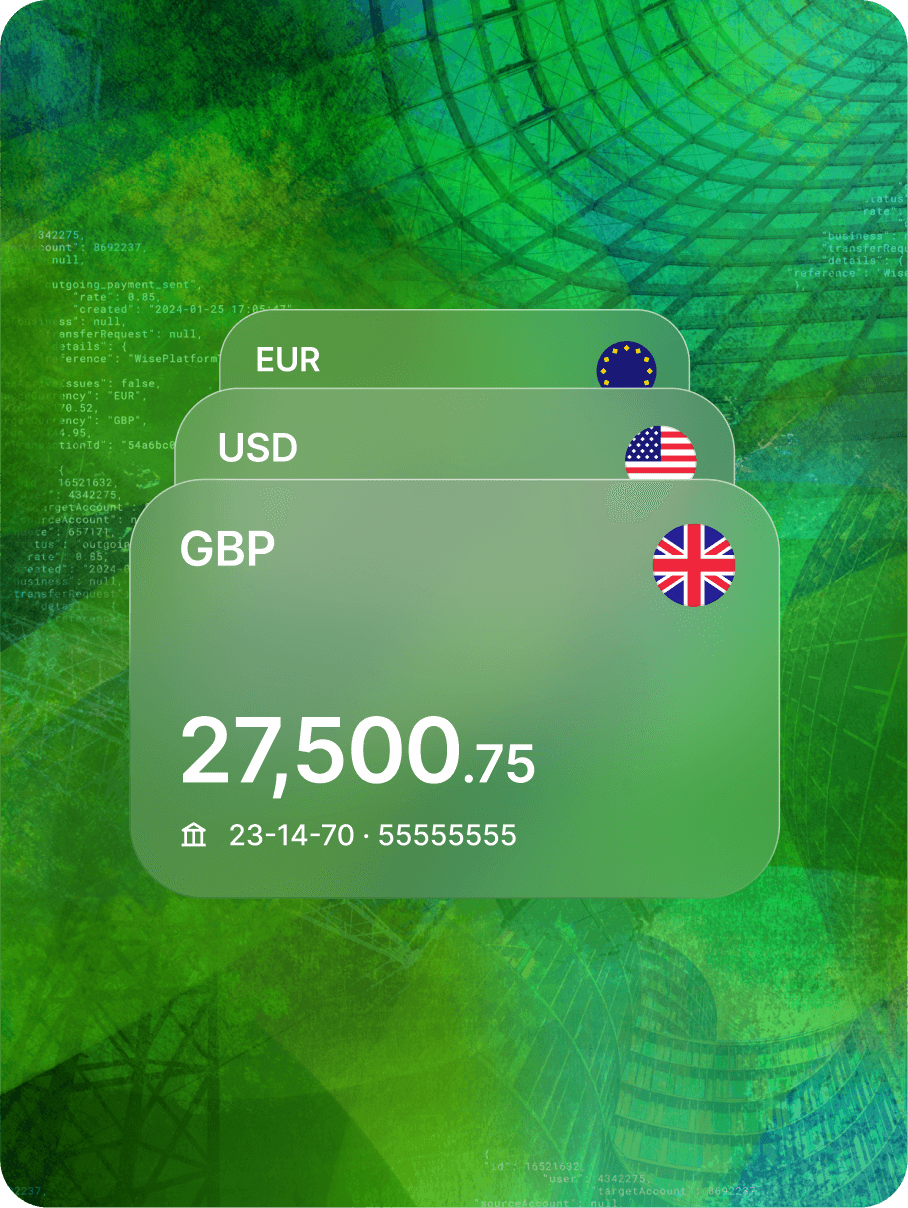

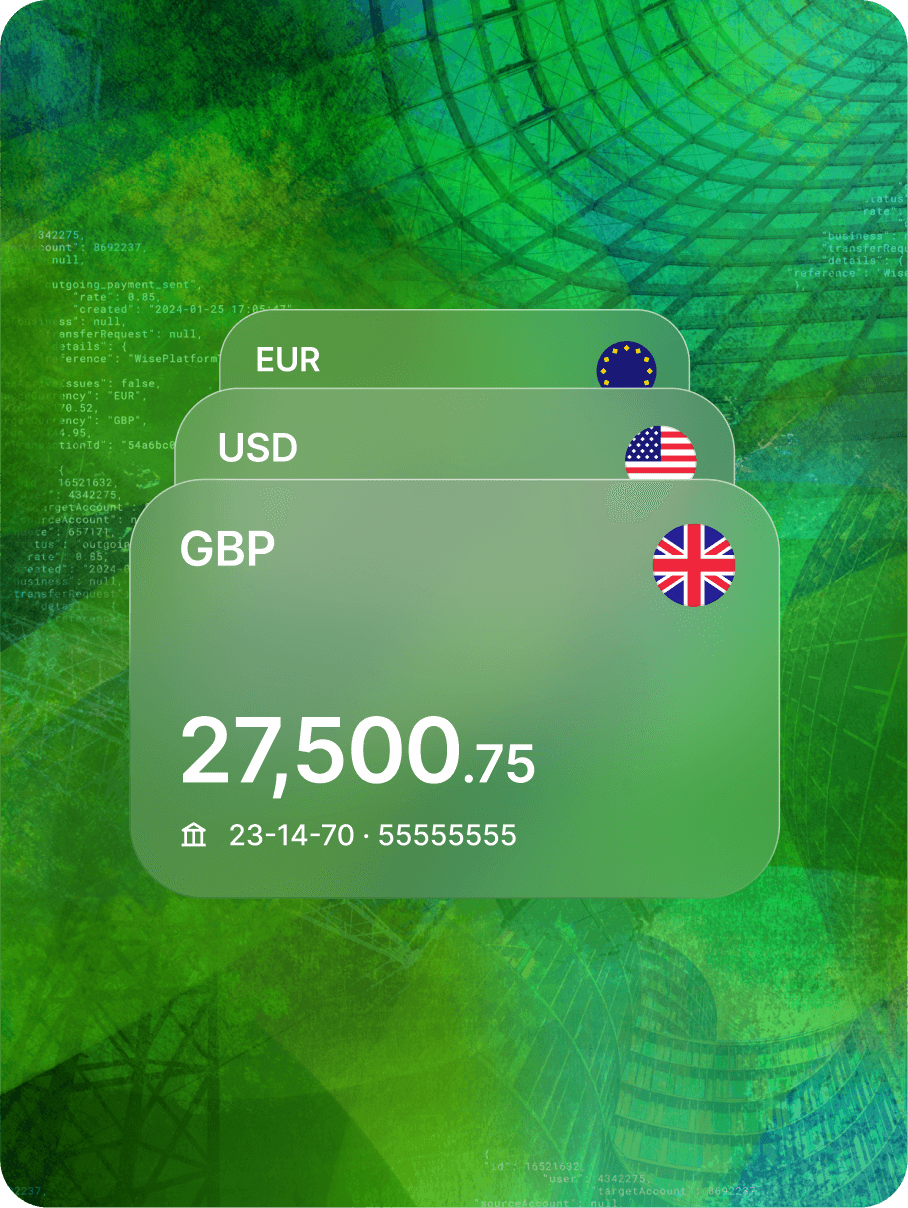

Transform your global payments experience

Integrate Wise Platform to provide your customers with seamless, transparent cross-border payment experiences. Make it easy for them to know when their money will arrive and how much it will cost – helping optimise your backend servicing costs.

High completion rates and user satisfaction

74% of payments take under 20s; 85% take under 1 hour; 96% arrive in under 24 hours

8,000+ experts powering our highly-rated Wise UX and CX

Transform your global payments experience

Integrate Wise Platform to provide your customers with seamless, transparent cross-border payment experiences. Make it easy for them to know when their money will arrive and how much it will cost – helping optimise your backend servicing costs.

High completion rates and user satisfaction

74% of payments take under 20s; 85% take under 1 hour; 96% arrive in under 24 hours

8,000+ experts powering our highly-rated Wise UX and CX

- Provide an experience that helps drive loyaltyProvide an experience that helps drive loyalty

Make it easy for your customers to transfer money internationally using your products, providing them with a user-experience of such high-quality that they won't feel the need to switch to another provider.

- Control your customer servicing costsControl your customer servicing costs

Connect with a blend of automated payment systems and local experts to achieve over 99% straight-through processing rates, helping you greatly reduce your support and operational costs.

- Build trust with fast, transparent paymentsBuild trust with fast, transparent payments

With a resilient global network and a high NPS-scoring user experience road-tested over 15 years with millions of customers, our infrastructure sets the bar for global payments customers love.

Seamlessly optimise your global payments network

Open up the currency routes your organisation needs – without a costly technical overhaul. Our infrastructure is straightforward to integrate and trusted by top neo banks such as Monzo through to renowned transactional banks like Morgan Stanley.

Simple integrations using Swift or API

160+ countries, 40+ currencies, 70+ licences

>99% STP rate and direct participation in 8 domestic payment networks

Seamlessly optimise your global payments network

Open up the currency routes your organisation needs – without a costly technical overhaul. Our infrastructure is straightforward to integrate and trusted by top neo banks such as Monzo through to renowned transactional banks like Morgan Stanley.

Simple integrations using Swift or API

160+ countries, 40+ currencies, 70+ licences

>99% STP rate and direct participation in 8 domestic payment networks

- Deliver instant payments with scalable complianceDeliver instant payments with scalable compliance

Our robust fraud-detection models run all checks in real time. Together with a team of 1,000+ experts worldwide, we offer the scale and adaptability to help keep your regulatory risk minimised.

- Access 24/7/365 FX coverage worldwideAccess 24/7/365 FX coverage worldwide

Our combination of unique banking expertise, cutting-edge technology, and engineering, delivers seamless treasury management. We work with 50+ local liquidity partners and can process payments 24/7.

- Dial-back reliance on payment intermediariesDial-back reliance on payment intermediaries

With direct participation in 8 domestic payment networks plus access to hundreds of payment rails, plug in seamless money movement with less reliance on aggregators and intermediaries.

Plug-in the products designed to lower costs and boost loyalty

Deliver fast, dependable global payouts

Access one of the world’s largest local payment networks with a dedicated focus on making cross-border payouts faster, more transparent, convenient and low cost.

- Direct participation in 8 domestic payment networks

- 74% of payments in under 20s; 96% under 24hrs

- Covers 160+ countries and 40+ currencies

Partnering with us

We’ll collaborate with you across the delivery journey

- Structured approach to deliveryStructured approach to delivery

You’ll benefit from proven work-streams developed to guide your team from project initiation to launch. We’ll partner with you to define timelines and ensure a low-friction, efficient integration.

- Dedicated team to guide and support youDedicated team to guide and support you

Deep expertise and guidance is available to you throughout your integration. We share best-practice and learnings on building the right product for you and your customers.

- Deep dive workshops and trainingDeep dive workshops and training

Available to you and your team, covering topics such as: Product & Tech; Compliance; Settlement & Ops; Customer Support and; Go-to-Market activities.

CONNECT SEAMLESSLY WITH SWIFT OR API

Access our infrastructure using either a Swift message or the API – moving money globally is simpler than ever