What is Swift money transfer?

Making a Swift money transfer with Wise is as easy as sending a wire to anyone else. You’ll be able to use your own bank’s online or mobile banking service, or set up your Swift transfer by phone, or in a branch - whatever you’d normally do. That makes a Swift money transfer familiar and convenient, no matter where you’re sending money to.

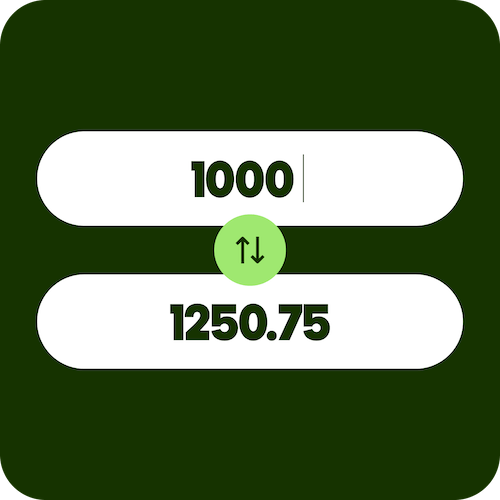

Swift money transfers with Wise may have the highest available payment limits, and your money will usually be received pretty quickly by Wise. That means Wise can get it moving to your recipient quicker, too.

Learn more about using Swift wire transfers.